JUDI MOBILE LEGEND

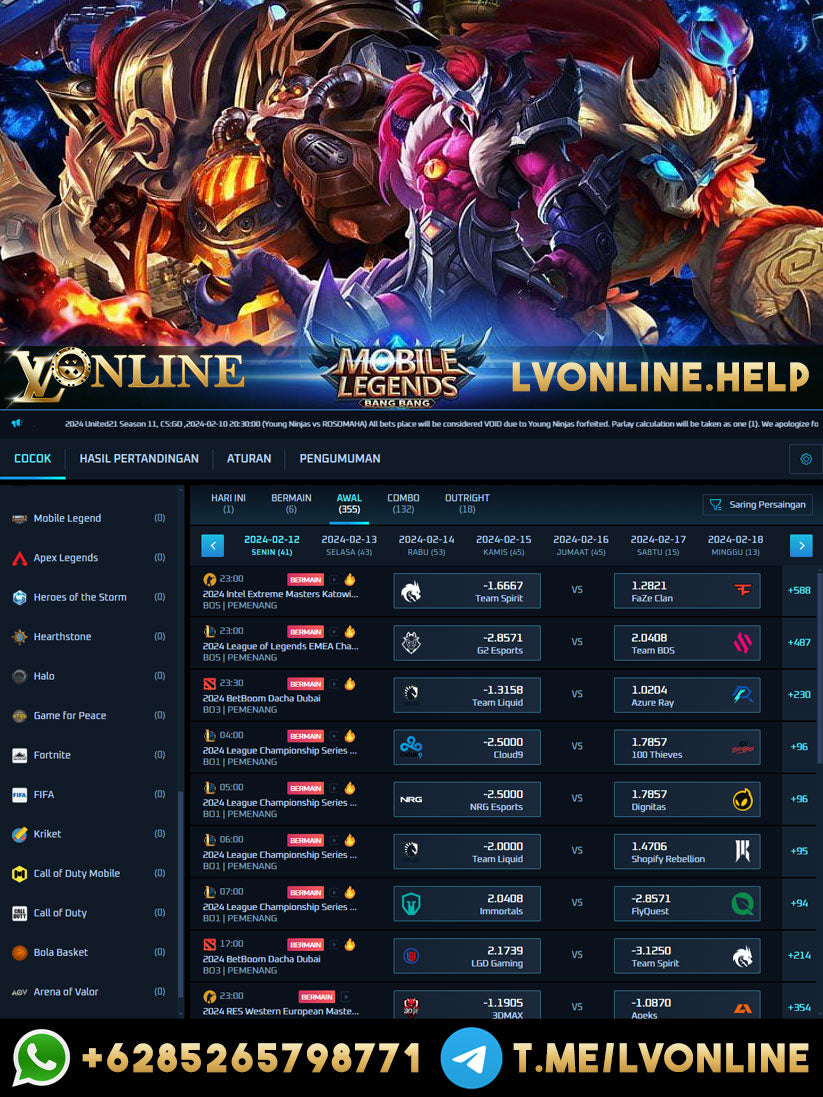

Judi Mobile Legend Situs Taruhan Esport Online Terbaik 2024

Judi Mobile Legend Situs Taruhan Esport Online Terbaik 2024

Couldn't load pickup availability

Situs bandar judi mobile legend atau taruhan mobile legend online terbaik tahun 2024 menggunakan uang asli Indonesia Rupiah dengan odds terlengkap dan keuntungan terbesar.

Transformasi Esport Mobile Legends melalui LVONLINE: Sebuah Tinjauan Mendalam

Pendahuluan

Dalam beberapa tahun terakhir, esport telah tumbuh menjadi fenomena global yang memikat jutaan pemain dan penonton. Salah satu gim yang memimpin gelombang ini adalah Mobile Legends: Bang Bang. Dengan popularitasnya yang terus berkembang, platform seperti LVONLINE memberikan ruang bagi para penggemar untuk terlibat dalam pengalaman taruhan dan kompetisi yang mendalam. Artikel ini akan menjelaskan bagaimana LVONLINE dapat menjadi jembatan antara komunitas Mobile Legends dan dunia esport.

Mobile Legends: Bang Bang dan Fenomena Esport

Mobile Legends: Bang Bang, dikembangkan oleh Moonton, adalah gim mobile yang menggabungkan strategi dan keterampilan taktis. Sejak diluncurkan, Mobile Legends telah menjadi salah satu gim esport paling populer di seluruh dunia. Pemain dari berbagai lapisan usia dan latar belakang terlibat dalam kompetisi tingkat tinggi, dan turnamen besar diselenggarakan secara berkala.

Peran LVONLINE dalam Esport Mobile Legends

LVONLINE adalah platform yang menyediakan layanan taruhan dan interaksi komunitas untuk para penggemar Mobile Legends. Dengan menggunakan mata uang lokal, e-wallet, dan bahkan pulsa, LVONLINE memungkinkan para pemain untuk terlibat dalam taruhan, meningkatkan intensitas pengalaman esport mereka.

1. Taruhan Menggunakan Rupiah, E-Wallet, dan Pulsa

LVONLINE memberikan kemudahan kepada pemain dengan menyediakan berbagai opsi pembayaran, termasuk rupiah, e-wallet, dan pulsa. Ini menciptakan fleksibilitas dalam berpartisipasi bagi mereka yang ingin merasakan sensasi taruhan esport tanpa kendala pembayaran yang sulit.

2. Keamanan dan Transparansi

LVONLINE mengutamakan keamanan dan transparansi. Dengan menggunakan sistem yang terkini, pemain dapat yakin bahwa informasi pribadi dan transaksi mereka terlindungi dengan baik. Selain itu, adanya transparansi dalam proses taruhan dan pembayaran membantu menciptakan pengalaman yang adil dan tepercaya bagi para pemain.

3. Komunitas Esport di LVONLINE

LVONLINE bukan hanya tempat untuk taruhan, tetapi juga pusat komunitas bagi para penggemar Mobile Legends. Forum, acara, dan kontes komunitas diciptakan untuk membangun hubungan antar-pemain dan merayakan keberagaman komunitas esport yang berkembang.

Esport dan Pengembangan Karir

Seiring dengan pertumbuhan komunitas esport, LVONLINE juga berperan dalam memberikan dukungan bagi pemain profesional. Turnamen yang diselenggarakan oleh LVONLINE dapat menjadi panggung bagi pemain Mobile Legends untuk menunjukkan bakat mereka, dan ini dapat membuka pintu bagi pengembangan karir profesional dalam dunia esport.

Kesimpulan

LVONLINE menjadi bagian integral dalam melibatkan komunitas Mobile Legends dalam ekosistem esport. Dengan memberikan kemudahan akses, opsi pembayaran yang beragam, dan fokus pada keamanan, LVONLINE memberikan nilai tambah bagi para penggemar yang ingin mengambil bagian dalam taruhan esport. Melalui inovasi ini, LVONLINE membantu membangun pengalaman esport yang lebih kaya dan terjangkau bagi semua pemain Mobile Legends.

Share